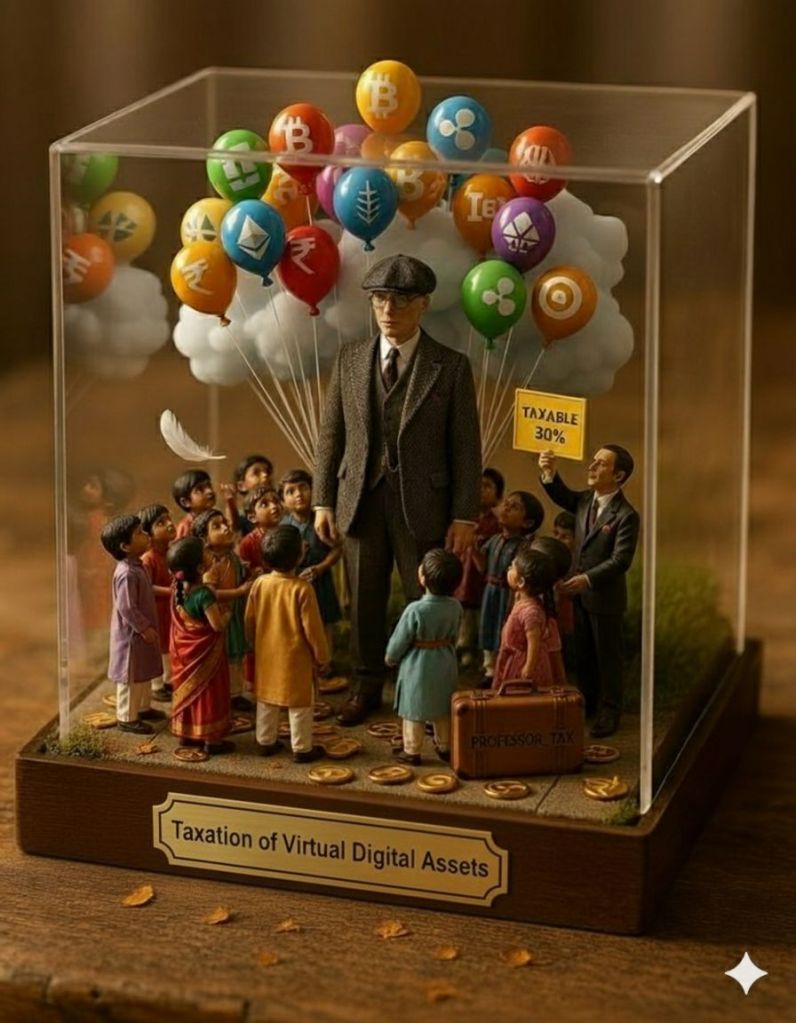

1 Overview of the Indian VDA Tax Framework

India’s taxation framework for Virtual Digital Assets (VDAs) establishes a comprehensive system for tracking and taxing cryptocurrency transactions. Introduced through the Finance Act of 2022, this regime defines VDAs broadly to include cryptocurrencies, NFTs, and other digital tokens. The system employs a multi-layered approach with three key tax components that apply uniformly across all types of digital assets.

1.1 Core Tax Components

· Income Tax on Transfers

· Rate: 30% (plus applicable cess and surcharge)

· Key Features: Flat rate regardless of holding period. Only cost of acquisition is deductible; no deductions for expenses like gas fees, electricity costs, or other operational expenses.

· Limitations: No distinction between short-term and long-term holdings; no indexation benefits.

· Tax Deducted at Source (TDS)

· Rate: 1%

· Key Features: Applied to the total transaction value above specified thresholds. Must be deducted by the buyer in peer-to-peer transactions.

· Limitations: Impacts liquidity as tax is deducted at source; must be considered in transaction planning.

· Goods and Services Tax (GST)

· Rate: 18%

· Key Features: Levied on service fees charged by crypto platforms (e.g., trading fees), not on the value of the crypto asset itself.

· Limitations: Additional cost on transaction fees and platform services.

The Indian government has implemented this framework to bring transparency and compliance to the digital asset ecosystem while maintaining oversight of financial transactions. The structure presents unique challenges for traders and investors due to its limited deductions and restrictive loss treatment provisions.

2 What Constitutes a Taxable Event?

Under Indian tax law, nearly every transfer of Virtual Digital Assets qualifies as a taxable event, regardless of whether the transaction results in a profit or loss. Understanding which activities trigger tax liabilities is essential for compliance and accurate tax reporting.

2.1 Common Taxable Events

· Trading VDAs: This includes exchanging cryptocurrency for fiat currency (INR) or trading one cryptocurrency for another. Each swap between different digital assets constitutes a separate taxable event that must be reported individually.

· Staking rewards: Income generated through staking cryptocurrencies is taxable as ordinary income at the time of receipt, based on its fair market value. When these assets are later sold, the 30% tax applies to any gains made from their appreciated value.

· Mining income: Cryptocurrency obtained through mining activities is taxed as income at the recipient’s applicable income tax slab rates. The cost of acquisition for mined crypto is considered zero, meaning no deductions are allowed for expenses like electricity or equipment costs.

· Airdrops and hard forks: Tokens received through airdrops or created through hard forks are treated as taxable income once they are credited to your wallet. The valuation is based on the fair market value at the time of receipt.

· Receiving payment in crypto: Any compensation received in cryptocurrency for goods, services, or as salary is considered taxable income. This income is taxed at your standard income tax slab rates in the year of receipt.

· Gifts of VDAs: Receiving digital assets as gifts may trigger tax implications if the total value exceeds ₹50,000, unless received from specific exempt categories like relatives.

2.2 Non-Taxable Events

· Holding digital assets in your wallet without transferring them

· Transferring cryptocurrencies between your own wallets

· Purchasing VDAs with fiat currency (though this may trigger TDS requirements)

3 Tax Compliance and Reporting Requirements

3.1 TDS Thresholds and Application

The 1% TDS requirement under Section 194S applies once your annual VDA transaction volume exceeds specific thresholds:

· ₹50,000 threshold: Applies to “specified persons” – individuals or HUFs without business income or with business turnover below ₹1 crore/professional receipts below ₹50 lakh in the previous financial year.

· ₹10,000 threshold: Applies to all other persons, including individuals with business turnover exceeding ₹1 crore, companies, firms, and other entities.

For transactions on Indian exchanges, TDS is typically handled automatically by the platform. However, when using foreign exchanges or engaging in peer-to-peer (P2P) transactions, the responsibility for deducting and depositing TDS falls on the buyer.

3.2 Income Tax Return Filing

· Schedule VDA: From the financial year 2023-2024 onwards, taxpayers must report all VDA transactions in the dedicated “Schedule Virtual Digital Assets” in their ITR forms. This separate schedule ensures specific tracking of VDA transactions.

· ITR Form Selection: Most individuals report VDA transactions using ITR-2 (for capital gains) or ITR-3 (for business income). The choice depends on whether your VDA activities qualify as investment or business trading.

· Record Keeping: Maintain detailed records of every transaction, including dates, type of asset, quantity, value in INR, wallet addresses, and exchange statements. These records are crucial for accurate reporting and potential audits.

· Deadlines: For most individuals not requiring an audit, the deadline for filing income tax returns is typically July 31 following the financial year.

4 Special Transaction Types and Their Tax Treatment

4.1 Crypto-to-Crypto Trades

Each trade between different cryptocurrencies constitutes a taxable event for both parties involved. The transaction is treated as selling one asset (triggering gains or losses) and buying another, with both valued at their fair market price in rupees at the time of the trade. For example, trading Bitcoin for Ethereum requires calculating gains/losses on the Bitcoin disposition and establishing a new cost basis for the Ethereum received.

4.2 Airdrops and Mining Income

· Airdrops: Tokens received through airdrops are taxed as “Income from Other Sources” at their fair market value when received. This income is taxed at your applicable income tax slab rates. When you later sell these tokens, the 30% tax applies to any gains, with the previously taxed value serving as your cost basis.

· Mining Rewards: Cryptocurrency obtained through mining is taxed as ordinary income based on its fair market value at receipt. The cost of acquisition is considered zero for calculating gains when the mined crypto is later sold, and no deductions are allowed for mining-related expenses.

4.3 NFT Transactions

Most NFT transactions fall under the VDA tax regime and are subject to the 30% tax on transfers. However, Notification No. 75/2022 excludes certain NFTs from the VDA definition, particularly those whose transfer results in the transfer of ownership of an underlying tangible asset with legally enforceable ownership transfer.

5 Regulatory Environment and Recent Updates

5.1 Anti-Money Laundering (AML) Compliance

Virtual Digital Asset Service Providers, including cryptocurrency exchanges, must register with India’s Financial Intelligence Unit (FIU-IND) and comply with the Prevention of Money Laundering Act (PMLA). Recent enforcement actions have targeted offshore platforms operating without proper registration. Always use FIU-IND registered platforms to ensure regulatory compliance and proper TDS implementation.

5.2 Income Tax Act, 2025

The newly passed Income Tax Act, 2025 modernizes India’s tax code but does not change the fundamental tax rates or framework for VDAs. Key aspects include:

· Effective from April 1, 2026

· Broadens the definition of VDAs to cover any asset holding value in digital form using cryptographic ledger systems

· Introduces the concept of “Tax Year” to replace “Assessment Year” and “Previous Year” for simplicity

· Streamlines TDS provisions by grouping them under a single section for easier compliance

5.3 GST on Crypto Services

Since July 2025, 18% GST applies to services provided by crypto platforms, including trading fees, staking services, wallet management, and other platform charges. This GST is levied specifically on the service fees, not on the value of the crypto assets themselves.

6 Key Strategic Considerations for VDA Investors

6.1 Critical Limitations in the Tax Framework

· No loss set-off or carry-forward: Losses from one VDA transaction cannot be set off against gains from another VDA or any other income source. These losses also cannot be carried forward to future years, making them essentially “dead losses”. This treatment is significantly stricter than other capital assets.

· No distinction between short-term and long-term: The 30% flat tax rate applies regardless of your holding period. This eliminates the tax advantage typically available for long-term investments in other asset classes.

· Limited deductions: Only the cost of acquisition is deductible when calculating gains. No deductions are permitted for expenses like transaction fees, gas fees, wallet charges, or other costs associated with managing digital assets.

6.2 Compliance Strategy

· Choose compliant exchanges: Prioritize platforms registered with FIU-IND to ensure proper TDS implementation and regulatory compliance.

· Maintain meticulous records: Keep detailed, rupee-denominated records of every transaction, including dates, asset types, quantities, values, and associated fees. Consider using specialized crypto tax software for accurate tracking.

· International transaction diligence: When using foreign exchanges, remember you’re responsible for tracking all transactions, converting values to INR at applicable exchange rates, and manually complying with TDS requirements where necessary.

· Professional consultation: For complex activities like mining, staking, DeFi transactions, or frequent trading, consult with a tax professional specializing in VDAs to ensure compliance and optimize your tax position.

India’s VDA tax framework represents one of the strictest regimes globally, characterized by high tax rates, limited deductions, and restrictive loss treatment. While the system ensures transparency and regulatory oversight, it significantly impacts investment returns and strategy in the digital asset space. Staying informed about regulatory developments and maintaining scrupulous records remain essential for navigating this complex tax landscape successfully.

Decoding the Jargon: Simple Explanations

· Virtual Digital Assets (VDAs):

· This is the official Indian government term for cryptocurrencies (like Bitcoin, Ethereum), NFTs, and other similar digital tokens. If it’s a digital asset that uses cryptography and blockchain, it’s likely a VDA.

· 30% Income Tax on “Transfer”:

· Transfer doesn’t just mean selling for cash. It includes almost any exchange, like:

· Selling crypto for rupees (₹).

· Trading one crypto for another (e.g., Bitcoin for Ethereum).

· Using crypto to buy goods or services.

· Giving away crypto (in some cases).

· You pay a flat 30% tax on the profit from any of these “transfers.”

· 1% TDS (Tax Deducted at Source):

· Think of this as a small advance tax that is cut automatically during the transaction itself.

· For example, if you buy crypto for ₹100,000, the exchange will deduct ₹1,000 (1%) as TDS and pay you ₹99,000 worth of crypto. This helps the tax department track all transactions.

· Cost of Acquisition:

· This is simply the original price you paid to buy the crypto asset. It’s the only cost you can subtract from the selling price to calculate your profit. Other expenses like platform or gas fees don’t count.

· No Loss Set-Off or Carry-Forward:

· Set-Off: Normally, if you lose money on one investment, you can use that loss to reduce the tax on profit from another. This is NOT allowed with crypto.

· Carry-Forward: Normally, if you have more losses than gains in a year, you can carry those losses to future years to reduce future taxes. This is also NOT allowed with crypto.

· In short, crypto losses are “dead losses” and provide no tax benefit.

· Schedule VDA:

· This is a special section or form in your Income Tax Return (ITR) specifically for reporting your crypto transactions. You must use this dedicated section and not the one used for stocks or mutual funds.

· FIU-IND Registration:

· The Financial Intelligence Unit – India (FIU-IND) is a government agency that fights financial crimes like money laundering.

· FIU-IND registered exchanges are platforms that follow Indian rules, making them safer and ensuring they handle TDS correctly.

· Crypto-to-Crypto Trade as a Taxable Event:

· This is a crucial and often misunderstood point. Even if you don’t convert your crypto back to Indian Rupees (₹), swapping one token for another is a taxable event.

· Example: Trading Bitcoin for Ethereum is treated as: 1) Selling your Bitcoin (calculate profit/loss), and then 2) Buying Ethereum. You owe tax on the profit from the “sale” of Bitcoin.

· Airdrops & Mining Rewards as “Income from Other Sources”:

· When you get “free” crypto (from an airdrop or from mining), it’s treated as extra income in the year you receive it.

· This “income” is taxed not at the flat 30%, but at your normal income tax slab rate (like your salary). Later, when you sell this free crypto, the 30% tax will apply on any further profit.

· GST on Service Fees:

· You pay an 18% GST (Goods and Services Tax) only on the fee charged by the crypto exchange or platform for facilitating your trade. You do not pay GST on the total value of your crypto transaction.